IR6 Question 25 Trustee income and calculation of tax

Calculation of taxable income

Question 25A

If the result is negative the amount will be taken into account in the loss carried forward to the following year.

Calculation of tax and tax on taxable distributions

Question 25B

If the trust has received a taxable distribution and tax has not been paid, calculate tax at 45 cents in the dollar and add it to the total.

Credit for tax paid overseas

Question 25C

The amount of the credit for tax paid overseas on trustee income is limited to the amount of New Zealand tax on that income.

Remember to attach evidence of payment to page 3 of your return.

Dividend imputation credits

Question 25E

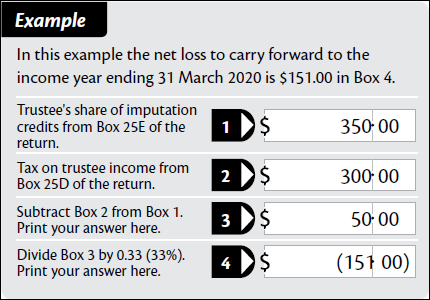

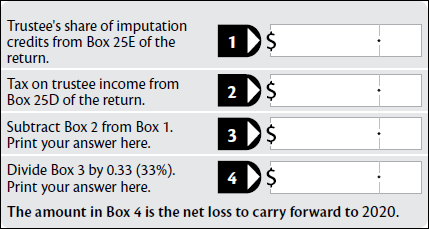

If the trustee’s share of the imputation credit exceeds the tax on trustee income at Box 25D, the excess credit can’t be refunded. Write 0.00 in Box 25F. The excess credit is converted to a net loss to carry forward to the following year.

To calculate the net loss to carry forward to 2020, use the worksheet below. Inland Revenue will send you a notice confirming the amount of loss to carry forward.

Worksheet

Trustee’s share of RWT and other credits

Question 25G

The following amounts should be added together and printed in Box 25G:

the trustee’s allocation of RWT (Boxes 9A and 10A)

the trustee’s share of Maori authority credits (Box 11A)

the trustee’s share of partnership, estate or trust tax credits (Box 12A)

the trustee’s share of LTC tax credits (Box 14A)

the total from Box 16A.

the trustee's share of any residential land withholding tax credit (Box 16AA).

Don't include any amounts already shown in either Boxes 24L or 24N of the IR6B.