Reports

The following reports can be generated for Taxation assets:

(Australia) Low value pool schedule

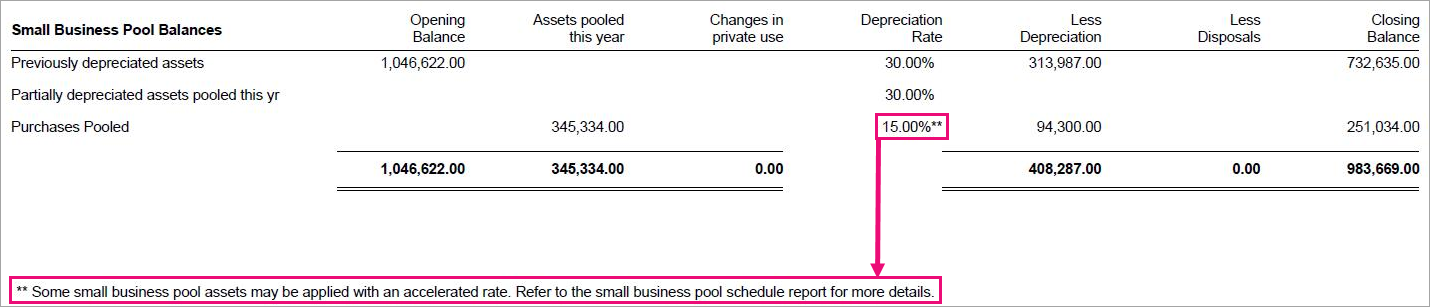

(Australia) Small business pool schedule

Full Schedule

The following reports can be generated for Accounting assets:

For New Zealand, there's also a no pool report.

Reports are available for all asset years included in the asset register irrespective of their status.

In the Full Schedule Report and Tax Schedule Report, you'll see a note about an accelerated rate. This reminder appears in the reports whether or not you're using the accelerated rate.

To apply accelerated depreciation for assets, either:

- from Assets, click the asset year and click Apply accelerated rate on the Tasks bar, or

- to use MYOB Practice, from Assets, click View in browser on the Tasks bar and follow the steps in Accelerated depreciation rules.