Migrating from Series 6/8 to PM Plus

This page will show you the steps that are required to move from series 6/8 integration to PM Plus.

Before you begin

Your AE version is 5.4.47 and series version is 8.35/6.51 (tax version 2023.1) or later.

Access your SQL server to run this installation.

Disable any anti-virus software.

Ensure that all the users are out of Accoutants Enterprise and no one is logging in during the installation process.

PM Plus migration doesn't support tax returns with 1-many relationships (i,e, one client code attached to returns with multiple return codes). See the Troubleshooting section below to fix any returns for the migration to continue.

Consulting Services are available to do this upgrade for you. Email csaccounting@myob.com for more information.

If your Corporate Compliance Integration is still to Profiles, either an upgrade to AE Integration is required OR this will break the integration.

Troubleshooting

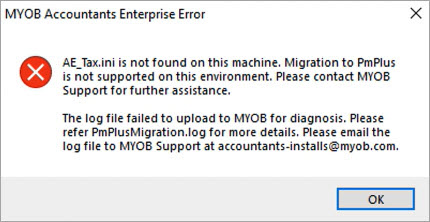

Error | Fix |

|---|---|

1-many relationships found on your Tax database. Migration to PM Plus is not supported. Please contact MYOB support for further assistance. | Take note of the client groups with one-to-many relationships. Follow the steps below to fix and re-run the utility. A one-to-many relationship is when one client code is linked with multiple tax returns with different return codes. To fix this, you'll need to log in to System Release and either

|

For any other errors | Contact support. |

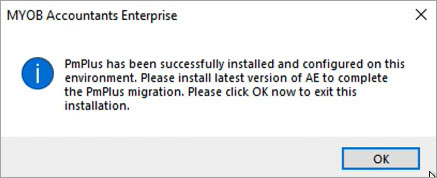

Next steps

Workflow changes

There are a few workflow changes in AE that you need to know. See our MYOB Academy course.Future updates

When you log in to my.myob for any future updates, you'll no longer see AE Series 6/8 in your Product, but you'll see AE Tax. There is only one file to download that will update Tax, Client Accounting, Document Manager, and Practice Manager.

Related links

Need help?

Contact support.