Moving from Series 6 & 8 integration (Admin centre) to PM Plus

What is Series 6 & 8 integration?

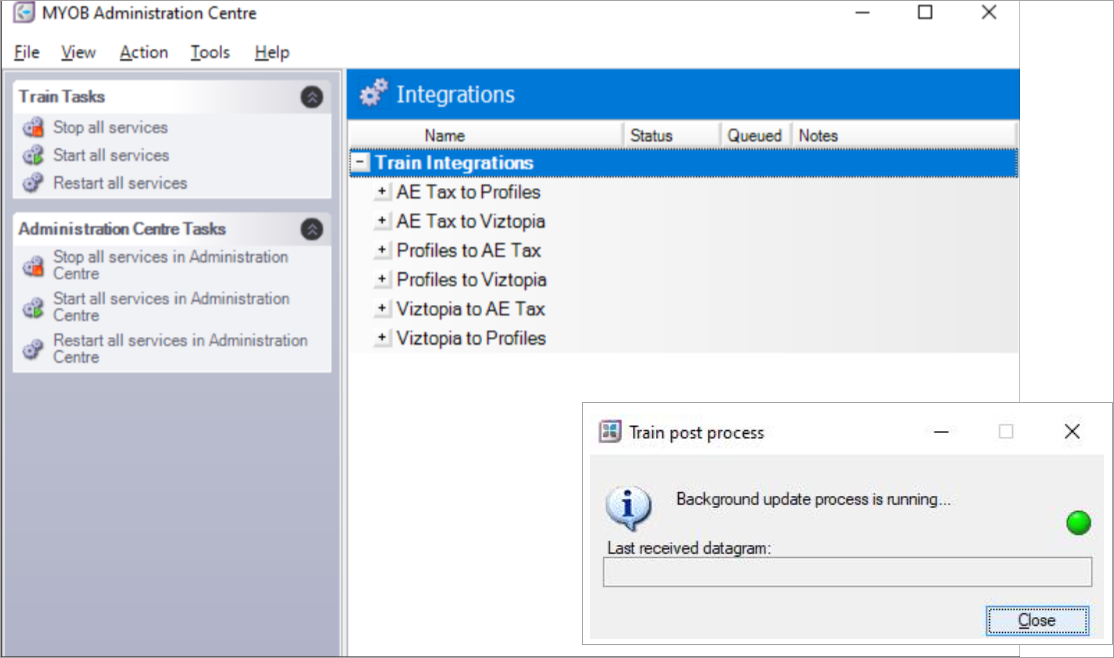

Series 6 & 8 integration (also known as MYOB Administration centre and background post process) allows MYOB AE to connect with Tax, Client Accounting, Practice Manager, Profiles, Accounts, and SQL databases.

It relies on old Microsoft technology that is already retired. In order for your software to continue integrating correctly, you'll need to move from Series 6 & 8 integration to PM Plus.

Series 6 & 8 integration is also used for Client Accounting, Practice Manager, Profiles and SQL databases. It was also required if you used the Accounts module.

However, this change only affects AE with Series 6 & 8 and Tax.

Key Dates

Product Integration | End of support | What will be available when support ends? |

|---|---|---|

AE with Series 6 & 8 and Tax. | 15 June 2024 1 July 2024 (No Tax 2024 release) | After 15 June 2024, we'll no longer support any integration issues between Series 6 & 8 and Tax. On 1 July 2024, if you're still on series 6 & 8 integration, we won't be releasing tax updates for the 2024 tax year. You won't be able to lodge tax returns for 2024. You'll be able to see historical tax returns, but won't be able to make any lodgements for future years. |

AE with Series 6 & 8 and Practice Manager, Document Manager or Client Accounting. | No support end date. | Access to downloads, installation and product support will continue. |

AE with PM Plus. | No support end date. | Access to downloads, installation and product support will continue. |

AO with PM Plus. | No support end date. | Access to downloads, installation and product support will continue. |

Why move to PM Plus?

Series 6 & 8 relies on an outdated Microsoft tool, which we can no longer support. This means MYOB AE will stop integrating with Practice Manager, Tax and Accounts.

PM Plus is the new integration tool that will replace Series 6 & 8 and ensure your MYOB software continues to work properly with AE.

By moving to PM Plus you'll:

get access to future tax-year updates and support, including migration from MYOB AE to MYOB Practice tax.

no longer need to have background processes running on your server for MYOB software integration to work. The SQL databases communicate directly with each other.

All of our MYOB Accountants Office customers and around 60% of Accountants Enterprise customers are already using PM Plus integration for a number of years. This newer technology more reliable and compliant.

What will change after moving to PM Plus?

This is a back-end change and you won't notice much difference, aside from your software continuing to work correctly. There won't be many changes to your workflow, but installations and upgrades will be simpler.

Installs and upgrades

You’ll only have one file to download and install, instead of needing multiple installation files.

The installer will automatically install Practice Manager, Document Manager, Corporate Compliance and AE reports for the current year.

AE Reporter will still require a separate installer.

You don't need to have an active background post-process session running on the server.

MYOB AE workflows

Most of the tasks remain the same when you move to PM Plus, but you may notice some differences:

When creating a tax return directly in AE rather than from client compliance.

Tax agent details integrate from return properties, and you don't need to assign a tax agent to a partner first.

Backups can be scheduled within AE without having the background processes running on the server or using any Microsoft Windows tasks. This means you don't need to do Datasafe backups anymore.

You can continue to use Accounts for your existing clients.

If you haven't moved to PM Plus, we'll continue to support your Practice Manager, Document Manager and Client accounting modules.

When should you move to PM Plus?

You'll need to have moved by 14 June 2024.

You can either:

follow the install guide to move to PM Plus or

contact your Customer success manager to help you with the transition.

If you want MYOB to help you with the transition, we recommend making a booking by 14 December 2023 deadline. This will avoid any capacity constraints and to ensure we can dedicate appropriate time to assist you. Email csaccounting@myob.com to get in touch.