Tax 2023 issues

This support note applies to:

- AE Tax Series 6 & 8 (AU)

- AE Tax (AU)

- AO Tax (AU)

This page is a reference for all 2023 issues that are outstanding or resolved in an update. We'll keep adding issues to this page as they're found.

The What data pre-fills into Tax? 2023. If pre-filled data doesn't have as much information as you're expecting, it may be because it's too early in the financial year for the ATO to consider the data as tax ready.

| Issue | Solution | Ref no |

|---|---|---|

| Install errors | ||

Accountants Enterprise only If you use Tax tracking to roll over from the previous year, tax return statuses aren't appearing. | Add/Edit Status Levels 2023. | 01366619 |

| After a Windows update, the workstation installation fails at the prerequisite tests. | Contact us for help with completing the workstation installation. | 01365189 |

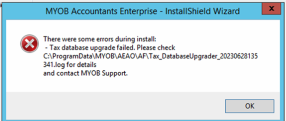

Error: There were some errors during the installation. Tax database upgrade failed.

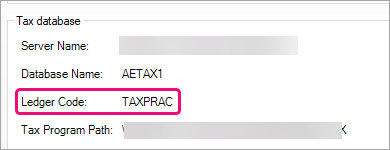

This error might happen if you use custom tax ledger codes in system release. | If you use custom tax ledger codes, then this error will not cause any issues with the functionality of AE and all features will work correctly. To check if you use custom tax codes:

If you're getting this error and the Ledger code is Tax, call our support team. | 01363657 |

Series 6 or 8 only Tax 2023 is not displaying after the Bulk RSD process runs in Client Compliance. | Open tax returns by going to the MYOB AE Tax returns homepage and double-clicking the tax 2023 return link. | 01372068 |

| Individual tax return | ||

Capital gains amount incorrect when rolling over tax returns from 2022 to 2023. | When rolling over the tax return, the amount at Item 18 V incorrectly rolled over from the BW schedule. We're aware of this issue and will be addressed in the next release. | 01429555 |

| CPI rates are incorrect. | We're aware of this issue and will be addressed in the next release. | 01437993 |

| In a 2023 individual tax return, the SAPTO calculation is incorrect in the estimate. | Manually calculate and edit a tax estimate manually. | 01473136 |

| The AE/AO tax estimate calculation is incorrectly including HELP debt repayments, even if the client is exempt because of the Medicare levy reduction due to low family income. | Manually calculate and edit a tax estimate manually. | 01400751 |

Occupation code discrepancy As per the ATO guidelines, we've removed the occupation code 341111 from AE/AO but the ATO has not updated their website and this code still exists on the list. | You will not find 341111 code in AE/AO. | - |

For some labels in a 2022 tax return, if you add rows with amounts in addition to the first row, the amounts are incorrectly rolling forward to 2023. This occurs for the following labels:

| This issue is fixed in the 2023.0a hotfix release | 01366759 |

IITR.730088 - Assessable foreign source income is incorrect. This issue occurs when Foreign entity CFC income and Foreign entity transferor trust income are incorrectly included when calculating the Assessable foreign source income on the main return. This issue happens in the 2022 and 2023 tax years. | This issue is fixed in the 2023.0a hotfix release. | 01359197 |

Warning IITR.W00002: Check AASIS details have been provided correctly. This error occurs in the Australian superannuation income stream worksheet. | This issue is fixed in the 2023.0a hotfix release. | 01359181 |

The ATO has notified us about the following rejection codes that may occur when selecting some occupation codes. - CMN.ATO.GEN.XBRL03: filed contains invalid data: The value specified for an item does not match the item type - CMN.ATO.GEN.XBRL04 | This issue is fixed in the 2023.0a hotfix release. | 01359168 |

Prior year capital loss (pyl) worksheet rollover When rolling over a capital loss from 2022 to 2023, the pyl worksheet does not populate with the capital loss amount. The correct amount populates in the tax return label. | This issue is fixed in the 2023.0a hotfix release. | 01363081 |

| Company return | ||

| Vaildation error CTR.500370 CTR.500317 | This error happens when there is a loss carry back offset at Item 13 label S is less than 50 cents. We're aware of this issue and working on a solution. As a workaround, adjust the amounts at Item 6 and Item 7 so the offset is greater than 50 cents. or Enter the amount directly in Item 13 with no cents, and delete the loss carry back worksheets (lcc and lcb). | 01445938 |

2023 - Items 7J and 7L not printing in ELD and tax estimate. | The following items are not included and not reducing the taxable income when printing the ELD and tax estimate.

| 01408371 |

Rollover of H1 Credit for interest on Early payments amount. The amount at H1 Credit for interest bn Early payments does not rollover into the 2023 tax return if there's no interest income worksheet in the 2022 tax return. | This issue is fixed in the 2023.0a hotfix release. | 01359210 |

| Activity statements | ||

V23 - Invalid value, cannot be negative This issue occurs when the PAYG instalment income (label T1) is 0 and the Commissioner’s rate (T2) or Varied rate (T3) is greater than 0 then the amount at label T11 (5A) calculates as -1. | This issue is fixed in the 2023.0a hotfix release. | 01359683 |