Section D: Tax Calculation Statement

This Tax Calculation Statement works out the tax liability where there is taxable income.

Apart from label G Section 102AAM interest charge, the amounts for the labels on the right-hand column are determined from values integrated from return labels in the return and from MYOB tax worksheets and are not available for edit. Click the button to open an integrating worksheet.

From the information entered in the Calculation Statement, Tax provides an estimate of current year tax payable. And certain labels of the calculation statement are used to calculate the Commissioner's instalment rate for quarterly and annual payers under the PAYG income instalment system for the next income year. It is important to complete all labels as accurately as possible to ensure that the rate calculated results in a reliable estimate of tax payable for the current income year.

Tax will provide a PAYG Instalment estimate (click F4 at any time). Alternatively, the estimate will be produced at the time of printing the return when selecting Reports > Print Return.

For PAYGI What-if scenarios, click Preparation > Schedule > PAYG (Instalment income estimate) or code pgF.

Item 13 the Calculation Statement tab comprises these labels:

Taxable income is automatically calculated by Tax from values entered in the Income and Deductions sections of the return and is the amount calculated at label O Taxable income or loss if positive. A zero will be defaulted to label O where the fund has no income or has sustained a loss.

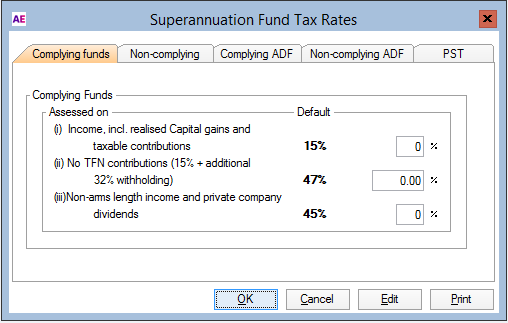

Label T1 Tax on taxable income is calculated by MYOB Tax in accordance with the following rates:

The compliance status of the SMSF affects the tax rates that apply. If the fund is a regulated superannuation fund, ADF or PST and you have not received a Notice of non-compliance from APRA, then the fund is a complying fund and the standard tax rate is 15%. If the fund is a non-complying fund the standard tax rate is 45%.

Different tax rates apply to the following types of income:

U Net non-arm's length income item 11

T Assessable income due to changed tax status of fund item 11.

If you have shown an amount at label R3 No-TFN quoted contributions MYOB Tax includes in the calculation of the amount at label T1 Tax on taxable income the tax calculated on taxable income at the standard rate (or the correct rate for net non-arm's length income or assessable income due to changed tax status of fund). The additional tax on No-TFN quoted contributions is shown at label J in the Calculation Statement.

Shown at label J No-TFN quoted contributions tax is the amount of additional tax payable on no-TFN quoted contributions shown at R3 No-TFN quoted contributions (32% for complying superannuation funds and 2% for non-complying superannuation funds) adding up to an overall tax rate for tax on no-TFN contributions 47%.

If the amount shown at R3 is 0, then the amount shown at label item 13, label J will be 0.

Refer to example 5 in the ATO Fund instructions for further information.

Note that the additional tax shown at label J No-TFN quoted contributions tax must be included at B Gross tax. MYOB Tax automates the calculation of Gross Tax at label B.

Gross tax is automatically calculated by Tax based on the Taxable Income at item 12 label O where the amount is positive.

Different tax rates apply to the following types of income and MYOB Tax will automatically calculate the correct rate of tax should any of them be included in the taxable income:

Contributions shown at label R3 No TFN quoted contributions item 11. An additional 32% tax levy for complying funds and an additional 2% Medicare levy for non-complying funds.

Net non-arm's length income shown at label U Net non-arm's length income item 11 Tax is calculated at 45%.

Assessable income due to SMSF tax change in status shown at label T Assessable income due to changed tax status of fund item 11 Tax is calculated at 45%.

You must ensure that the correct rate of tax is applied to each type of income when completing label B.

The compliance status of an SMSF is taken into consideration when applying the relevant rates of tax. A SMSF is considered a complying SMSF until a Notice of Non-Compliance is issued by the ATO.

If the SMSF is a regulated SMSF and you have not received a notice of Non-compliance, the SMSF is considered a complying fund and a tax rate of 15% applies to income other than the income listed above.

CCH References

42-035 Superannuation Fund Rates

The amount to be shown at label C1 is the SMSF’s self-determined foreign income tax offset.

Use the Foreign income worksheet (for) to record the previous 5 years excess foreign income tax which will be required for the correct calculation of the foreign income tax offset entitlement for the current year. If the offset entitlement calculated exceeds Gross tax payable, you must limit the offset so that Gross Tax payable is no less than NIL.

For the purposes of calculating the foreign income tax offset, transitional rules determine the amount of pre-commencement excess foreign income tax than can be used. Pre-commencement excess foreign income tax consists of certain excess Foreign income tax offsets from the five years prior to commencement of the new rules.

For more information on calculating foreign income tax offsets, refer to Guide to foreign income tax offset rules (NAT 72923) available on the ATO website.

If the SMSF received franked distributions from a New Zealand franking company, refer to Trans-Tasman imputation in the ATO Fund instructions.

Also see Foreign income worksheet (for).

CCH References

21-670 Foreign income tax offsets

Show at label C2 the total of rebates and tax offsets available and not the amounts giving rise to that tax rebate or tax offset. If the SMSF is a complying SMSF, complying ADF or PST do not include franking credits that relate to dividends received (including non-share dividends) and assessable dividends from a New Zealand franking company). Show these at label E1 Complying funds franking credit tax offsets item 13.

If the SMSF is claiming a no-TFN tax offset in respect of tax paid on No-TFN contributions income in any of the most recent three income years, do not claim the offset at this label. Claim it at label E2 No-TFN tax offset.

Tax provides a holding dialog at label C2 which is filled from values entered at return labels and is filled in accordance with the Status of the fund. The holding dialog also provides for the manual entry of relevant amounts. If the fund is ‘complying’ then integration of franking credits amounts from the dialog is directed to label E1.

Also see Rebates and Tax Offsets (C2).

CCH References

13-160 Tax offsets, losses and other concessions

This subtotal is the result of deducting the sum of labels C1 Foreign income tax offset and C2 Rebates and tax offsets shown at C Non-refundable non-carry forward tax offsets from label B Gross tax. The amount at label T2 cannot be negative.

If the amount at label C Non-refundable non-carry forward tax offsets is more than or equal to the amount at label B Gross tax, a zero will be defaulted to both Subtotals T2 and T5 Tax payable. The remainder will be defaulted to label E Refundable tax offsets.

CCH References

13-160 Tax offsets, losses and other concessions

This offset is a non-refundable carry forward tax offset. The worksheet at label D1, the esv, is designed for record keeping purposes and for managing the carrying forward of any excess ESVCLP tax offset not claimed in 2018. Click the label to open the worksheet.

CCH References

20-700 Outline of innovation incentives

Show at label D2 the amount of unused ESVCLP tax offset carried forward from the previous year, less any reductions, if applicable.

The unused ESVCLP tax offset carried forward from a previous year may need to be adjusted for any net exempt income.

CCH References

20-700 Outline of innovation incentives

This offset is a non-refundable carry forward tax offset. The worksheet at label D3, the esi, is designed for record keeping purposes and for managing the carrying forward of any excess ESIC tax offset not claimed in the current year. Click the label to open the worksheet.

CCH References

20-700 Outline of innovation incentives

Show at label D4 the amount of unused early stage investor tax offset carried forward from the previous year, less any reductions, if applicable.

The unused ESVCLP tax offset carried forward from a previous year may need to be adjusted for any net exempt income.

- Label D- Non-refundable carry forward tax offsets. This is the sum of labels D1, D2, D3, and D4.

CCH References

20-700 Outline of innovation incentives

This subtotal is the result of deducting the sum of labels D1–D4 from label T2 (B less C). The amount at label T3 cannot be negative.

If the SMSF is eligible for a refund of excess franking credits, show at label E1 the amount of franking credits relating to dividends (or non-share dividends) including venture capital franked dividends paid and assessable dividends from a New Zealand franking company.

Press [Enter] at this Label to open the holding dialog which is filled from the amounts entered at:

income labels L and E at item 11,

the Distributions from Trusts worksheet (dft) and

the Distributions from Partnerships worksheet (dfp).

Integration to E1 is based on the Status of the Fund. If the fund is non-complying, integration will be to C2.

Also see Distributions from partnerships worksheet (dfp) and Distributions from Trusts worksheet (dft)

CCH References

4-820 Refund of excess franking credits

13-170 Non-arm's Length Income

Show at label E2 the no-TFN tax offset claimed.

An Interest on no TFN offset (ito) is provided at E2 No TFN offset and H6 Credit for interest on no-TFN tax offset in the Calculation statement to assist with these calculations and their integration to the main return labels. Click either of labels E2 or H6 to open the ito worksheet.

Because SMSF members are either trustees of the SMSF, or directors of a corporate trustee, it is very rare for an SMSF to pay no-TFN-quoted contributions tax, and therefore very rare for SMSFs to be entitled to a no-TFN tax offset. Penalties may apply if you claim a no-TFN tax offset that the SMSF is not entitled to.

Also see Interest on no-TFN tax offset worksheet (ito)

Legislation

Section 67-23 and Subdivision 295-J of the Income Tax Assessment Act 1997

CCH References

13-180 Tax on no-TFN contributions

Show at label E3 the amount of National rental affordability scheme tax offset entitlement.

Click this link for information on the NRAS from the ATO website.

At label E3 press Enter to open the holding dialog which collects any share of Rental affordability scheme tax offset distributed from a Partnership or Trust relating to the period 1 July to 30 April of the current income year. Refer to Distributions from Trusts worksheet (dft) and Distributions from partnerships worksheet (dfp)

The holding dialog also provides 2 fields to enter amounts received from FaHSCIA Certificate and/or the Joint Venture (NEJV) Manager.

CCH References

20-600 National Rental Affordability Scheme

20-605 NRAS Refundable tax offset

Show at E4 the amount of exploration credits received during the income year.

A fund may be entitled to a tax offset for exploration credits received during the income year if it was an Australian resident for the whole of the income year.

The amount of the tax offset is the total value of exploration credits the fund received in the income year. However, special rules may apply where the fund has received exploration credits from a partnership or a trust.

Show at label H1 only the calculated interest amount of 50 cents or more for early payments. Do not show payment amounts.

Keep a record of the amount of early interest claimed. This interest is assessable income in the income year in which it is paid or credited against another liability.

Click label H1 to open the Interest on Early Payments worksheet (epi) which will calculate the interest credit and integrate it to the label. Refer to Interest on early payments worksheet (epi).

Interest rates on early payments used in Tax can be confirmed by clicking Maintenance > Tax Rates > Early Payment Interest.

CCH References

25-440 Interest on Early Payments

The SMSF is entitled to a credit at H2 only if the amount was:

Withheld in Australia, and

Remitted to the ATO.

For more information, see PAYG withholding.

You do not have to calculate the value for label H2. Tax will collect the relevant amounts that make up the total tax withheld from payments subject to foreign resident withholding (FRW) from the following schedules and worksheets:

the (Payment summary schedule (PS) where the Income type is B and the Payment type is F

distributed share of FRW credits distributed to the SMSF recorded on a Distributions from partnerships worksheet (dfp)

distributed share of FRW credits distributed to the SMSF recorded on a Distributions from Trusts worksheet (dft).

[Enter] at Label H2 to open the holding dialog from which you may access the worksheets.

Any credit distributed from a Managed Investment Trust Fund will also be shown at this label.

Where a credit is claimed at label H2 for tax withheld under FRW, the corresponding gross payment must be declared at item 11 label I Gross distribution from partnerships or M Gross trust distributions or label S Other Income (gross payment subject to foreign resident withholding) item 11.

CCH References

22-000 Tax liability of non-residents

You do not have to calculate the Credit for tax withheld - ABN/TFN not quoted (non-individual) for label H3. Tax will collect the relevant amounts of income and related credits from the following schedules and worksheets:

Interest Income worksheet (int) - Entities and Interest Income worksheet (int) - Individuals

Payment summary schedule (PS), where the Income type is B and the Payment type is N. The Non-Individual Payment Summary is not deleted using Preparation > Delete schedules. To clear the payment Summary and values integrated to the return, open the schedule and delete the details from it. If you wish to retain the text, then delete the values from the $ amount fields only.

A field is provided for the entry of Other TFN amounts withheld, so that if you do not use the various worksheets you may key the already known amount.

The total of these amounts integrates to label H3.

Press Enter to open the holding dialog at H3.

If a credit is reported at H3 for tax withheld where an ABN or TFN was not quoted the corresponding gross payment must be declared at label H Gross payments where ABN not quoted item 11.

Do NOT include at H3 contributions that have been received by the SMSF where no TFN has been quoted. These should be included at label R3 No TFN quoted contributions item 11.

CCH References

33-030 TFNs and investments

33-130 Quoting an ABN

You do not have to calculate the total amount withheld from payments where you have not provided your TFN to the trustee of a closely held trust for label H5. Tax will collect the relevant amounts that make up the total from amounts entered in the:

Enter at the Label to open this dialog.

For information regarding the TFN withholding rules for closely held trusts, refer to the publication TFN withholding for closely held trusts available on the ATO website.

If the SMSF has not claimed a no-TFN tax offset at E2, it cannot claim a credit at H6.

If you have completed the Interest on no-TFN tax offset worksheet (ito) at E2 any interest on no-TFN credit will have been calculated and integrated to H6. To open the worksheet, click label H6.

Interest rates on early payments currently used in Tax can be confirmed by clicking Maintenance > Tax Rates > Early Payment Interest.

For interest rates and for information on calculating the interest to be applied on tax that counts towards the no-TFN tax offset visit the ATO website.

Keep a record of the amount of interest claimed. This interest is assessable income of the SMSF in the income year in which it is claimed and should be shown at item 11 C Gross interest.

CCH References

13-180 Tax on no-TFN contributions

Show at label H8 the total amount of tax withheld from payments to the SMSF that were subject to foreign resident capital gains withholding in Australia. Include at H8 the SMSF's share of foreign resident capital gains withholding credits distributed to the SMSF from its share of net income from a trust.

You should only claim at H8 a credit equal to the amount of foreign resident capital gains withholding paid by a purchaser to the ATO on your behalf. The ATO would have issued you with confirmation of this amount.

Do not include credits for amounts withheld from foreign resident withholding at H8. Include these at H2 Credit for tax withheld - foreign resident withholding.

For Label H-Eligible credits (H1 plus H2, plus H3, plus H5, plus H6, plus H8)

CCH References

22-072 Capital gains withholding regime for foreign residents

Show at label G the amount of interest calculated under section 102AAM in respect of a distribution received from a non-resident trust. Section 102AAM of the ITAA 1936 imposes an interest charge on certain distributions from non-resident trusts.

Any amount at G Section 102AAM interest charge is payable and will increase the T5 amount.

Refer to the ATO publication Foreign income return form guide (NAT 1840).

The amount to complete this field is stored in the Return Properties. If there is no amount at label K, press [Enter] to open the Return Properties PAYG/Lodge tab.

Label K PAYG instalments raised, rather than just paid, on your activity statements and other credits named under H Eligible credits will be applied against your tax payable amount to determine the amount due by the SMSF or refundable to the SMSF.

Depending on how you lodge Activity Statements for your clients, and whether you prepared the client’s prior year income tax return, PAYG Instalments paid for the 1st, 2nd and 3rd quarters will have been rolled over to the fields on the PAYG/Lodge tab.

Use amounts from the GST/PAYG Profile

If you lodge Activity Statements on behalf of your clients, the GST/PAYG Profile and, consequently, the Return Properties PAYG/Lodge tab will be updated with PAYG Income Tax Instalments (PAYGITI) paid and the sum of Quarters 1 to 4 will be included in the Estimate calculated by Tax as a credit if positive and a debit if negative.

Quarters 1, 2, 3: If amounts have not defaulted to this field from the GST/PAYG Profile, the total of them may be keyed, where no GST/PAYG Profile was maintained in the previous year or where the client is new to the Practice.

Quarter 4/Annual: This is the amount of the final instalment for the previous year. It will default from the Instalment tab found by clicking Preparation > GST/PAYG Profile and is derived as:

- the Q4 5A amount less the Q4 5B amount plus

- the Annual 5A amount less the Annual 5B amount.

Use Manually calculated value

If you do not use Tax to prepare and lodge Activity Statements on behalf of your clients and you do not update the GST/PAYG Profile Instalment Tab manually with the amount of Instalment tax paid, then you can key the amount to be included in the Estimate calculated by Tax. If the amount is negative, precede the value with a hyphen (-). The amount keyed as Total PAYG Instalments paid should be the total amount for the 4 Quarters whether they have been paid or not.

Show at label K the total of the SMSF's PAYG instalments for the income year of the tax return, whether the instalments have been paid or not.

Include the following amounts in the total instalment amount if the SMSF:

used the instalment amount(s) worked out by the ATO which the SMSF did not vary, include the amount(s) pre-printed at label T7 on the SMSF's quarterly activity statements or at label T5 on the annual instalment activity statement.

did not use the instalment amount(s) worked out by the ATO, include the amount(s) the SMSF reported at label 5A on the SMSF's activity statements, reduced by any credits the SMSF claimed at label 5B.

To ensure the SMSF receives the correct amount of credit for its PAYG instalments, make sure all its activity statements are finalised before lodging the SMSF return. If the SMSF is required to lodge its activity statements it should do so even if it can't pay on time, or had nothing to pay.

The SMSF is entitled to a credit for its PAYG instalments even if it has not actually paid a certain instalment. However, the SMSF will be liable for the general interest charge (GIC) on any outstanding instalment for the period from the due date for the instalment until the date it is fully paid.

Also see GST/PAYG Profile for the taxpayer and PAYG instalment income worksheet (xPF)

CCH References

27-100 PAYG Instalments

Label L is pre-filled with an amount that represents the SMSF's annual supervisory levy that must be paid to the ATO. This is a mandatory payment and the amount pre-filled to it may not be edited.

The supervisory levy for the current income year is $259.00. This levy will form part of your tax assessment calculation. As the levy forms part of your tax assessment calculation, it will be paid when you pay your income tax levy (if any) as advised in the letter issued to the trustee, which includes due dates for return lodgment and payment.

The supervisory levy is payable even if the SMSF has no tax liability for the year.

The amount at label S is automatically calculated by Tax.

CCH References

42-035 Superannuation Fund Rates