Getting started with Tax pre-fill

This support note applies to:

AO Tax (AU)

AE Tax Series 6 & 8 (AU)

AE Tax (AU)

Article ID: 39197

If you use MYOB Tax with PLS for lodgment, you can pre-fill your client's tax return from an ATO report.

This works for Individual Tax returns from 2017 onwards.

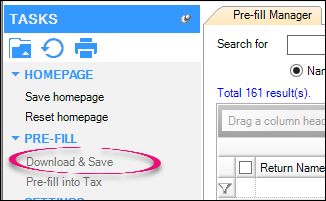

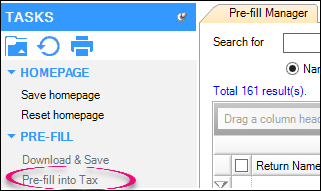

Follow these four simple procedures to get up and running.