Income details schedule (INCDTLS) 2023

See Granular data – level of detail required on the ATO's website.

In an individual return, most income items now have a new or revised worksheet. You need to use the worksheets to enter income into those items. You can no longer enter the amounts directly into these labels.

These worksheets are integrated into the Income Details schedule (INCDTLS) and lodged with the 2020 individual tax return.

If the taxpayer declares income in any of the items shown below, you must complete the relevant worksheet. When you create any of the worksheets below, the INCDTLS schedule is automatically created.

| Item | INCDTLS worksheet |

|---|---|

| Item 1: Salary or wages | |

| Item 2: Allowances, earnings, tips, director’s fees | |

| Item 3: Employer lump sum payments | |

| Item 4: Employment termination payments | |

| Item 5: Australian Government allowances and payments like Newstart, Youth Allowance, Jobseeker and Austudy payments | |

| Item 6: Australian Government pensions and allowances | Australian Government Pensions and Allowances worksheet (agp) 2023 |

| Item 7: Australian annuities and superannuation income streams | Australian superannuation income streams worksheet (asi) 2023 |

| Item 8 Australian superannuation lump sum payments | |

| Item 9: Attributed personal services income | Attributed personal services payments (aps) 2023 |

| Item 10: Gross interest | Interest Income worksheet (int) - Individuals 2023 |

| Item | INCDTLS worksheet |

|---|---|

| Item 11: Dividends | Gross dividends worksheet (div) 2023 |

| Item 12: Employee share schemes | Employee Share Schemes worksheet (emp) 2023 |

| Item 13: Partnerships and trusts | Distributions from partnerships worksheet (dip) 2023 |

| Item 14: Personal services income (PSI) | Business income statements and payment summaries (bip) 2023 |

| Item 15: Net income or loss from business | Business income statements and payment summaries (bip) 2023 |

| Item 19: Foreign entities | |

| Item 20: Foreign source income and foreign assets or property | |

| Item 22: Bonuses from life insurance companies and friendly societies | Item 22 - Bonuses from Life Insurance Companies and Friendly Societies 2023 |

| Item 23: Forestry managed investment scheme income | |

| Item 24: Other income |

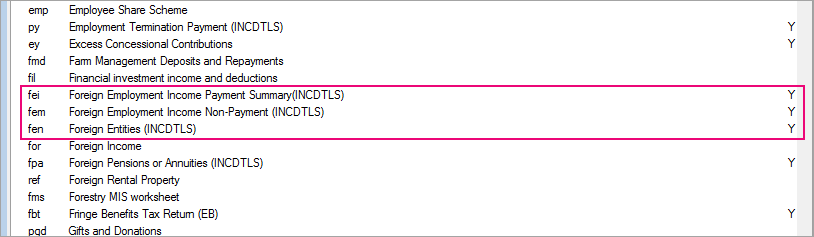

To help identify the Income details schedule worksheets, we've added the code INCDTLS at the end of the worksheet name and Y at the lodgable column.