MYOB AE/AO release notes—2024.0 (Australia)

Release date—June 2024

This is the latest version for:

Accountants Enterprise (AE)—MYOB AE 2024.0

Accountants Office (AO)—MYOB AO 2024.0.

Update 6 August

We’ve released Tax 2024.0b KB253689907 hotfix (Australia). Make sure to install the hotfix as it includes tax fixes and the Small business entity threshold changes and other fixes.

2024 Tax webinar

Learn about the ATO's 2024 tax compliance changes, access the 2024 tax tables, and new workflows in MYOB Practice tax. Register for a free MYOB tax webinar.

.png?inst-v=490ab03b-ac12-435a-9be4-4c95110c58a1)

What’s changing in AE/AO

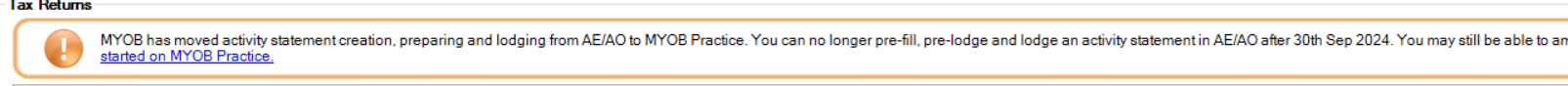

After installing 2024.0, you can no longer create new Activity statements in AE/AO.

If you have any existing activity statements, you can complete and lodge them by 30 September. After that, you can only amend activity statements.

Version/timeline | Create new

| Pre-fill/Pre-lodge | Lodge

| Amend (existing statements) |

|---|---|---|---|---|

Tax version 2024.0 (till 30 September 2024) | No | Yes | Yes | Yes |

Tax version 2024.0 and prior (after 30 September 2024) | No | No | No | Yes |

See Activity statement EOL FAQs for more information.

Upgrading to SQL 2019 is not mandatory before installing 2024.0. You can install 2024.0 and upgrade SQL later.

Upgrading to SQL 2019 is not mandatory before installing 2024.0. You can install 2024.0 and upgrade SQL later.

If you use AO, we’ve created a tool to help you upgrade from SQL 2014 to SQL 2019 as Microsoft will stop supporting SQL 2014 soon.

Learn how you can upgrade to SQL 2019 using the tool.

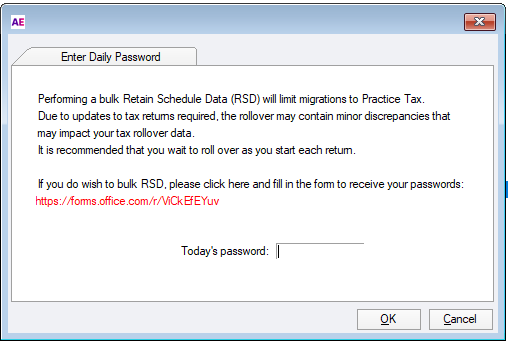

We’ve made some changes to the Bulk RSD routine. As we move towards the more streamlined online workflow in MYOB Practice tax, we recommend rolling over tax returns one at a time so the data rolls over accurately when you move online.

What are the changes?

When you perform a bulk RSD rollover after installing 2024.0, you’ll see a message to enter Today’s password.

To get the password click the form link and complete the details. We’ll then send you the password.

The passwords are valid only on the day mentioned and will expire afterwards. You’ll not be able to perform the Bulk RSD without entering the password.

2024 Tax changes

To access the PDF copy of the tax tables, go to Tax 2024: Tables, rates and thresholds.

CPI rates: Updated to 137.4 for the quarter ending March 2024.

Interest on Overpayments and Late Refunds: The rates are updated to the 2024 rates.

Government super co-contributions: The income thresholds are updated to the 2024 rates.

Dependant offset: The ATI threshold is updated to 2024 income.

Study and training loan repayment thresholds and rates: Updated to 2024.

Medicare levy: Income threshold updated to 2024.

Employment Termination Payments (ETP): ETP cap amount updated to 2024.

Super lumpsum cap: Low rate cap and untaxed plan cap amount to 2023 and 2024 tax year.

Depreciable Car Limit (DCL): The Motor Vehicles and Fuel Efficient Motor Vehicles is updated to $68,108.

Cents per km rate: Increased from 78 to 85 cents for 2024 in the Motor vehicle expenses worksheet.

Trust income schedule

As part of ATO’s change to Modernising trust administration systems, the ATO has introduced a Trust income schedule. This will assist with the correct income reporting and consistency across all beneficiary types required to lodge their tax return.

Read about the Trust income schedule on the ATO’s website.

Changes in MYOB Tax

The Trust income schedule layout is different depending on the return type.

Individual return: The Distributions received from trust (dit) worksheet has been modified to include all the fields required to complete the Trust income schedule.

Company, Fund, Partnership, SMSF, Trust: A new schedule called Trust income schedule (DISTBEN) has been included.

Small business instant asset write-off

Update on 1 July 2024

The threshold to increase the Small business instant asset write-off to $20,000 has passed both houses and received Royal Assent.

We’ve updated the threshold to $20,000 in Tax 2024.0a KB224821282 hotfix (Australia) release.

Read about the Small business asset instant write-off on the ATO’s website.

Temporary full expensing has ended

Temporary full expensing method for assets has ended on 30 June 2023.

You can't claim deductions under temporary full expensing for assets delivered, installed ready for use or improved after 30 June 2023.

Read about the Temporary full expensing on the ATO’s website.

We’ve removed the temporary full expensing labels in the following return types.

Individual | Company | Trust | Partnership |

|---|---|---|---|

Item P11 label C | Item 9 Label P | Item 50 label P | Item 49 label P |

Item P11 label D | Item 9 Label Q | Item 50 label Q | Item 49 label Q |

Item P11 label E | Item 9 Label R | Item 50 label R | Item 49 label R |

Item P11 label F | Item 9 Label S | Item 50 label S | Item 49 label S |

Item P11 label G | Item 9 Label T | Item 50 label T | Item 49 label T |

Item 9 Label U |

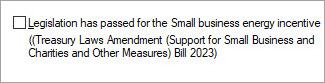

Small business energy incentive

Update on 1 July 2024

This Small business energy incentive measure has passed both houses and receives Royal Assent.

Follow the steps below to enable small business labels.

Open a 2024 return

Go to Utilities > Control Record > and select Legislation has passed for the small business energy incentive.

Now close and open the tax return. This will enable the labels for data entry.

The Small Business technology investment boost has ended, and ATO introduced the Small business energy incentive label.

Read about the Small business energy incentive on the ATO’s website.

Small businesses (with an aggregated annual turnover of <$50 million) can get access to a bonus deduction equal to 20% of the cost of eligible assets or improvements to existing assets that support electrification or more efficient energy use.

We’ve added the following labels so you can claim any eligible deductions.

Return type | New labels |

|---|---|

Individual | Item P12 Small business bonus deduction Label O Small business energy incentive |

Company | Item 7 - Label K Small business energy incentive |

Trust | Item 52 Small business bonus deductions Label C Small business energy incentive |

Partnership | Item 52 Small business bonus deductions Label C Small business energy incentive |

Government benefit certainty indicator

ATO has introduced 3 new fields at Item 5 - Australian Government Allowances and payments and Item 6 - Australian Government Pensions and allowances

Govt - Benefit certainty indicator - Pre-filled from ATO.

Australian government benefit adjustment reason - Select from the list of values if you need to adjust the value.

Australian government benefit adjustment reason description - If you select ‘Other’ reason, enter a description.

Worksheets removed

With the introduction of the trust income schedule, we’ve removed the consolidated trust distribution (ctd) worksheet.

New labels

ATO has introduced a new label at Item 24 - Digital Games offset.

The DGTO provides eligible game developers a 30% refundable tax offset for qualifying Australian development expenditure from 1 July 2022.

Labels removed/changed

Item 7 label P - Offshore Banking Units field (Item 7 Label P) has been removed.

Item 13 - The Loss carry back offset has ended in the 2023 tax year and the labels are removed.

This includes the Loss carry back summary worksheet (lcb) and Loss carry back tax offset component worksheet (lcc).Item 7 Label L Small business energy incentive (Small Business technology investment boost has ended.)

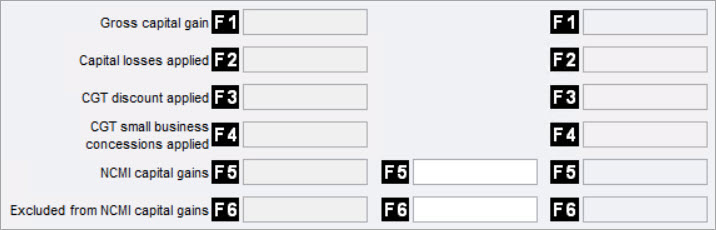

New capital gains labels

Read about the 2024 trust return changes on the ATO’s website.

As part of ATO’s change to Modernising trust administration systems, the ATO has introduced 4 new capital gains labels to the beneficiary distributions.

Use these labels to notify beneficiaries of their entitlement to income, and support the calculation of their CGT amount in their tax return.

These capital gain labels integrate into the respective labels that are being distributed into.

New validation rules from ATO

TRT.433088 - Type of trust must be a 'deceased estate' - code '059'

TRT.433089 - Type of trust must be a 'deceased estate' - code '059'

TRT.433090 - Type of trust must be a 'deceased estate' - code '059'

TRT.433091 - Type of trust must be a 'deceased estate' - code '059'

TRT.433102 -The beneficiary address and at least one positive TB statement information amount must be provided

TRT.433103 - The beneficiary address and at least one positive TB statement information amount must be provided

ATO has introduced these new errors in a 2024 trust return.

To fix these errors, make sure you’ve completed:

The Family trust election or Interposed entity election status field on the Front Cover

orthe TB statement question on the Distribution statement.

There are changes to IDS 2024 as below. Read about changes on the ATO’s website.

Section D - Thin Capitalisation.

Item 30

Item 30 Label A has been changed to Were the thin capitalisation rules applicable to you?

If you answer Y at Item 30a, Item 30B and Item 30c will be disabled.

Item 30 Label B has been changed to Did you rely on the $2 million threshold exemption?

If you answer Y at Item 30b, Item 30c onwards will be disabled

New label added: Item 30 label C: Did you rely on one of the following exemptions in determining the thin capitalisation rules did not disallow any of your debt deductions?

Item 32

Item 32 has been changed to What was your entity type for the income year?

Item 32a Label A added. This label is disabled by default and will be enabled if you choose Code 2 or 3 at Item 32.

Item 32b Label B added. If you answer Y, Item 32b Label B and Item 33 Label A will be disabled.

Item 35

New labels

Item 35 Label E & F

Item 35a - If you were a general class investor and you entered code 1 at question 32, provide your tax EBITDA information.

Item 35b - If you were a general class investor and you entered code 1 at question 32, did you rely on the group ratio test?

Item 35c - If you entered code 1, 2, or 3 in question 32, did you rely on the third party debt test?

Item 35d - Were you or a member of your tax consolidated group, a special purpose vehicle subject to section 820-39 of the ITAA 1997?

Items 36, 37 and 38

Item 36 description has been changed.

Item 37 changed to Were you a non-ADI and non-financial entity for the income year?

Item 37a Were you an investing financial entity (non-ADI) for the income year? has been added.

Item 38a has been added.

Item 39 has been changed.

Item 39a has been added.

Section E - Financial Services entities

Item 41 - Were you an Offshore Banking Unit (OBU) or the head company of a consolidated group that included an OBU? has been removed.

If you’re on version 2023.2, when rolling over a tax return, the ear-end routine window shows incorrectly instead of the RSD window. This is now fixed.

2024 lodgment

You can start lodging 2024 tax returns from June 21, 2024.

Prefill availability

The ATO have advised that pre-filled data is available from 1 July, with most data finalised by the end of July.

Read more on the ATO’s website

Client Accounting

We've edited and deleted to a number of paragraphs. Installing this update does not automatically update any Client or practice-level existing paragraphs that you've customised.

Check the changes below to find the paragraphs that have been changed at the client or practice level. To see the changes we’ve made, select Restore Default content (in the Edit Paragraph window). Then add any customised content if required.

Compilation report

We’ve added a new NTD field - Independence under Compilation Report.

Select this option if you are not independent of the entity. If you need to enter the details, select the Independence paragraph.

We've updated the Summary of significant accounting policies to Significant accounting policies in paragraphs Compilation Report - Body - C, P & I and Compilation Report - Body - OT & UT.Companies - Special Purpose report

If you have entered details in the Non-transaction data > Principal activities, it will now be printed in the introduction to the accounting policies.Accounting policies > introductions - Introduction text - Company

We have deleted Comparatives are consistent with prior years unless otherwise stated. It will still print via another paragraph

Accounting policies > basis of preparation - Special purpose (For companies, trusts, partnerships and Individuals)

We’ve deleted the following:First paragraph: [Client Details.Client Name]] is non-reporting since there are unlikely to be any users who would rely on the general purpose financial statements.

Second paragraph: unless otherwise stated.

Third paragraph: modified where applicable by the measurement at fair value of selected non current assets, financial assets and financial liabilities.

Last paragraph: Significant accounting policies adopted in the preparation of these financial statements are presented below and are consistent with prior reporting periods unless otherwise stated.

Special purpose entities (except SMSF & Associations)

We’ve updated the references to Summary of significant accounting policies to Significant accounting policies in the Summary of Significant Accounting policies-Heading paragraph.Cash and cash equivalents accounting policy

The words which are (after the wording 'known amounts of cash') are removed from this policy in the following paragraphs:Accounting Policies - Cash and Cash Equivalents - C, P & A

Accounting Policies - Cash and Cash Equivalents - I, UT & OT

Employment benefits accounting policy

We have removed the last 2 sentences from this policy in the following paragraph: Accounting policies - employee benefits - paragraph 2 - C, P, I, UT & OTCompilation report - Body

Under My/Our responsibility paragraphs, we have included the wording - (including Independence Standards) at the end of the Compilation report - Body - C, P & I paragraphAssociations

The introduction to Accounting Policies now includes details of the principal activities of the Association.

In Accounting Policies, 2 new paragraphs have been inserted for the Basis of Preparation.

The wording for Summary of significant accounting policies has changed to Material accounting policy information in paragraph Compilation Report - Body - Association.

In the Simplified disclosures (Tier 2). Paragraph = Basis of preparation - Association, the Summary of significant accounting policies is now called Material accounting policy information.

This is separate item to the above - we’ve changed the wording in the first paragraph for the accounting policy - revenue from contracts with customers.In the Accounting policy - lessee accounting, we have inserted the following sentence after the 1st paragraph - The association has chosen not to apply AASB 16 to leases of intangible assets.

We have deleted the following for Simplified Disclosures and Associations Leases Note:

Covid-19 concessions paragraph

Covid-19 concessions - amounts

Non-transaction data - Simplified disclosures (Tier 2) > Notes to the financial statements > Leases > Amount recognised in P&L arising from Covid-19 rent concessions.

We have changed the wording in both the Independent Audit Report and the Independent Audit Report - SDS. from a summary of significant accounting policies' to 'material accounting policy information' in the following paragraphs:

Simplified disclosures paragraph> Independent audit report - SDS > opinion paragraph 1 > association

Special purpose > Independent audit report > Opinion.

We have changed the wording from Significant accounting policies adopted in to Material accounting information relating to in the update to Basis of preparation - C, UT, OT, P, I - SDS paragraph.

We’ve removed the sentence relating to the changes in fair value in the Accounting policy - investment property paragraph.

We have made the following changes in Accounting policies - Financial instruments paragraphs:

Paragraph 1: We have added the following text to the last sentence of the opening paragraphs (except for instruments measured at fair value through profit or loss where transaction costs are expensed as incurred).

Paragraph 3: We have included the following items to the list of categories:

fair value through profit or loss - FVTPL

fair value through other comprehensive income - debt investments (FVOCI - debt)

Paragraph 7: All the existing text in this paragraph has been replaced. If you have changed this paragraph at the practice level or client level, ensure you open the paragraph and select Restore default content.

Paragraph 12: We have included the following new paragraphs to the Intangibles - SDS accounting policy.

We have included the following new paragraphs to the Intangibles accounting policy

Goodwill

Accounting Policies - intangibles - Goodwill 1 - SDS

Accounting Policies - intangibles - Goodwill 2 - SDS

Accounting Policies - intangibles - Goodwill 3 - SDS

Patents and trademarks Accounting policies - Intangibles - Patents and trademarks - SDS

Research and development Accounting policies - Intangibles - Research and development - SDS

Accounting policies - Intangibles - Useful life of amortisable intangibles assets

There is a new Non-transaction data field for useful life under Simplified disclosures (Tier 2) > Notes to the financial statements > Intangibles - Estimated useful life of each class of amortisable intangible asset.

We’ve deleted some wording from a lessee paragraph in the Accounting policy - Leases - SDS Paragraph name = Accounting policies - lessee accounting - paragraph 2.

We have inserted a new paragraph at the end of the 'lessor' paragraphs for Accounting policies - leases - lessor accounting - Paragraph 1 SDS Accounting policies - leases - lessor accounting - paragraph 2 - SDS

Self Managed Super Fund (SMSF) entities

We’ve inserted a new (2nd) sentence and changed some wording in the last sentence in Introduction text - SMSF paragraph.

Partnership statement - special purpose

We have removed the words - is not a reporting entity and this from the opening paragraph - Declaration - partnership - opening paragraph.

Appropriation statement

We’ve changed the income tax expense printing to Summarise the detail of the income tax expense when the associated account code was subcoded.Income tax expense note (Simplified Disclosures only)

The tax expense note summarised the tax expense when there were account type groups assigned to the account codes. This has been changed to 'Detail' - always.In the Appropriation reports, we have changed all items back to closing balance from net movement

Income Statement

Summarised Department Report

Consolidated Department Report

Income tax accounting policy - SDS

We have a new paragraph - Accounting policies - income tax - C, I, UT & OT - paragraph 5 - SDS in the income tax accounting policy for deferred tax.

We’ve updated the interest rates in the following workpapers:

Division 7A loan summary

Division 7A Loan Summary - 25 Years

Division 7A Loan Summary - 10 years

Income tax calculation (detailed) - company workpaper:

The Franking credit item was not linked to the Dividends received workpaper. This is now fixed.Dividends received workpaper

We have made a slight change to enable the total for franking credits to be linked from the Income tax calculation (detailed) - company workpaper

We’ve updated the ledger name from Essentials (pre March 2020) to AE/AO ledger in the Client Configuration window to align with MYOB Essentials End of life.

If you’re on the 5.4.49 version, we’ve fixed the following issues:

The distribution section of the Income Statement, Summary Department Report, and Consolidated Department Report was incorrectly reporting the net change instead of the closing balance.

The income statement reported only the rental expenses and not the rental income at net profit (loss) on rental operations. The Rental Statement - Consolidated shows both income and expenses and the correct profit/loss figure.

Previously, you were unable to edit a paragraph that was saved with no content. We have now fixed it and you’ll need to add a space before saving an empty paragraph so you can edit it later.

The following message will be displayed:

Unable to save without content. To leave the description blank, add a space (press the space bar) before savingTrade and other payables note

The total line was printed in non-current payables even when there were non-current payables . This has now been fixed.Income statement (Trust entity)

We’ve changed the references from Retained earnings to Undistributed profits (accumulated losses).Vested benefits paragraph (SMSF entity)

The vested benefits note truncated the amounts when margin settings were changed. This has now been fixed.Trade and other payables note

GST total does not appear in the trade and other receivables or payables note for swinging accounts. This is now been fixed.

Need help?

We're here to support you through this busy tax season.

Extended support hours

Phone: 1300 555 117 Fast key code 3 1

Monday 1 July 2024 - Friday 5 July 2024

8.00 am – 7.00 pm AESTSaturday, 29 June 2024 - Sunday, June 30 2024

9:00 am - 5:00 pm AEST.Saturday, 6 July 2024 - Sunday, 7 July 2024

9:00 am - 5:00 pm AEST.Saturday, 13 July 2024 - Sunday, 14 July 2024.

9:00 am - 5:00 pm AEST.

Outside of these times, our support hours are:

Monday to Friday

9:00 am to 5:00 pm

Submit a support request via my.myob

Check out our community forum.