IR7 Question 11 New Zealand interest

Include interest from all New Zealand sources at Question 11.

The interest payer will usually send you an RWT withholding certificate (IR15), or similar statement, showing the gross interest paid and the amount of RWT deducted.

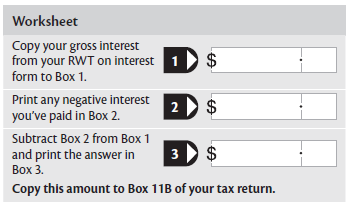

Write the total of all RWT deducted in Box 11A. Add up all the gross interest amounts (before the deduction of any tax) and write the total in Box 11B.

If expenses are deductible against the interest income (for example, commission), claim them at Question 21. Read the note about Expenses.

Don’t send in any interest statements or IR15 certificates with your return, but keep them in case Inland Revenue ask for them later.

Interest paid or charged by Inland Revenue

If Inland Revenue paid you interest, include it in Box 11B for the income year the partnership or LTC received the interest.

If the partnership or LTC paid Inland Revenue interest, include it as a deduction in Box 21 of the return for the income year the interest is paid. Read about Expenses.

Interest from overseas

If the partnership or LTC received interest from overseas, convert your overseas interest and tax credits to New Zealand dollars and show the amounts at Question 16. Please read the notes about Overseas income.

Income from financial arrangements

If the partnership or LTC was a party to a financial arrangement, such as government stock, local authority stock, mortgage bonds, futures contracts or deferred property settlements, you may have to calculate the income or expenditure from the financial arrangement using a spreading method, rather than on a cash basis. To work out if you must use a spreading method, please read “Financial arrangements”.

If the financial arrangement matures, is sold, remitted or transferred, you must do a “wash-up” calculation, known as a base price adjustment.

Any RWT will be deducted on a cash basis. Show the RWT deducted and any income from the financial arrangement in Boxes 11A and 11B.