How to complete IITR deductions 2024

The ATO has introduced a new Deductions schedule (DDCTNS) to lodge with a 2019 individual tax return.

This allows you to provide more information on deductions being claimed by your clients. See Claiming deductions on the ATO website.

When do you need a DDCTNS?

If you're claiming a deduction at any of the individual return labels ticked below, you'll need to complete a DDCTNS.

| D1 Work-related car deductions |

| D9 Gifts or donations |

| D2 Work-related travel expenses |

| D10 Cost of managing tax affairs |

| D3 Work-related clothing, laundry and dry-cleaning expenses | D11 - Deductible amount of undeducted purchase price of a foreign pension or annuity | |

| D4 Work-related self-education expenses |

| D12 Personal superannuation contributions |

| D5 Other work-related expenses |

| D13 Deduction for project pool |

| D6 Low-value pool deduction |

| D14 Forestry-managed investment scheme deduction |

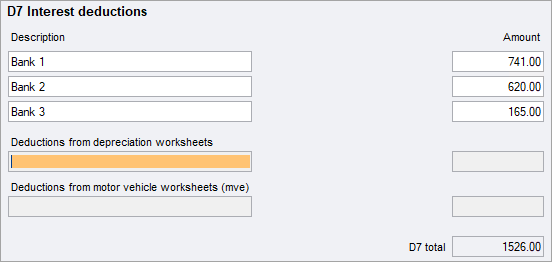

| D7 Interest deductions |

| D15 Other deductions |

| D8 Dividend deductions |

How to use the new DDCTNS

You can no longer enter data directly into the deduction labels D1–D15, (apart from label D11). Instead, you'll enter data either directly into the new DDCTNS or, in a supporting worksheet, which is then transferred to the DDCTNS.