Proof of identity verification

The Tax Practitioners Board (TPB) has recommended that all tax agents begin proof of identity verifications for their new clients. Strong client verification helps protect you and your clients from becoming a victim of identity crime which has increased with sophisticated technology.

To make this a smooth process, the ATO and TPB have developed guidelines to be used along with TPB's Proof of identity requirements for client verification for consistency and alignment.

Is the verification mandatory?

No, but the ATO and TPB recommend verifying your new clients straight away to minimise any risk of identity theft. This is expected to be made mandatory later in 2023.

Verifying your clients

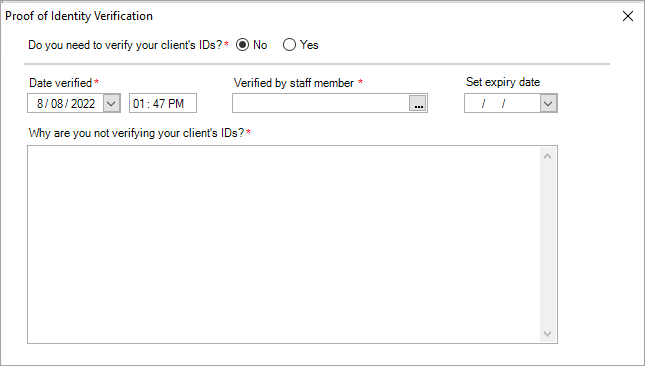

When you take on a new client, verify their proof of identity before providing any services.

The details that need to be verified depend on the type of client:

- Individuals

- Individuals (with a representative)

- Non-individuals

There are minimum requirements that are needed to verify the identity of a client.

For example, an individual client needs verification of their full name and date of birth and/or residential address, with at least one primary photo id such as a passport.

See the verification requirements from the Tax Practitioners Board (TPB) that shows what information should be verified and example of documents that can be used for identification.

Use the tpb_factsheet_-_proof_of_identity_checks_for_client_verification.pdf so they know what documents and information are required for verification.

Changes in AE/AO

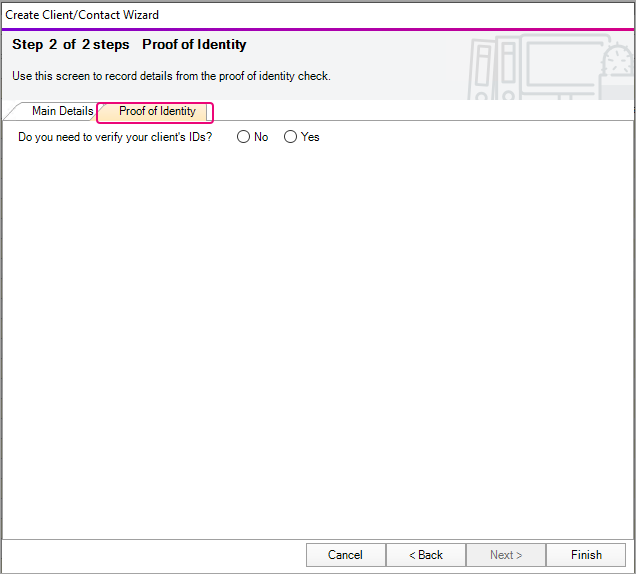

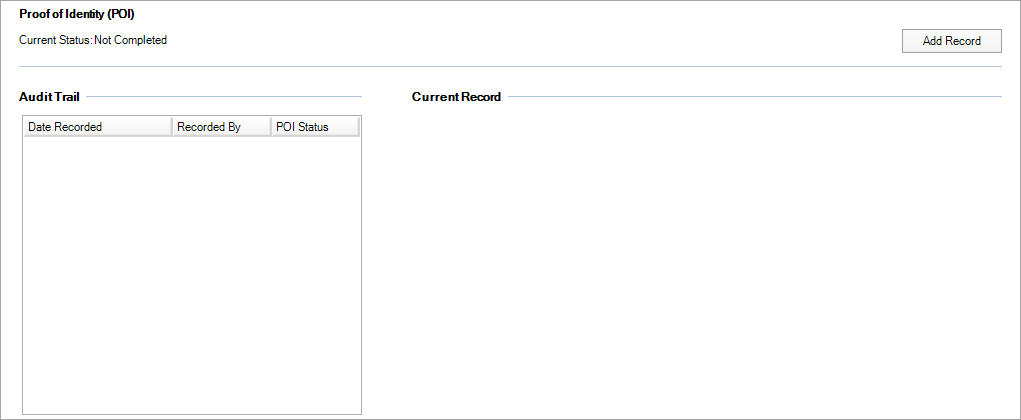

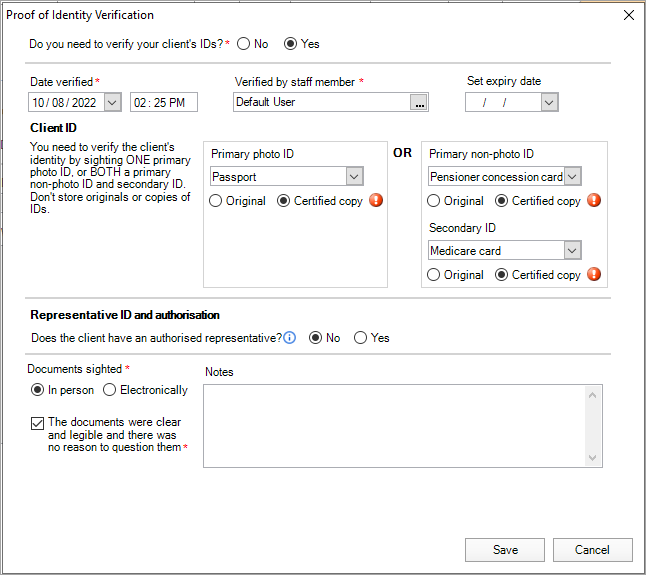

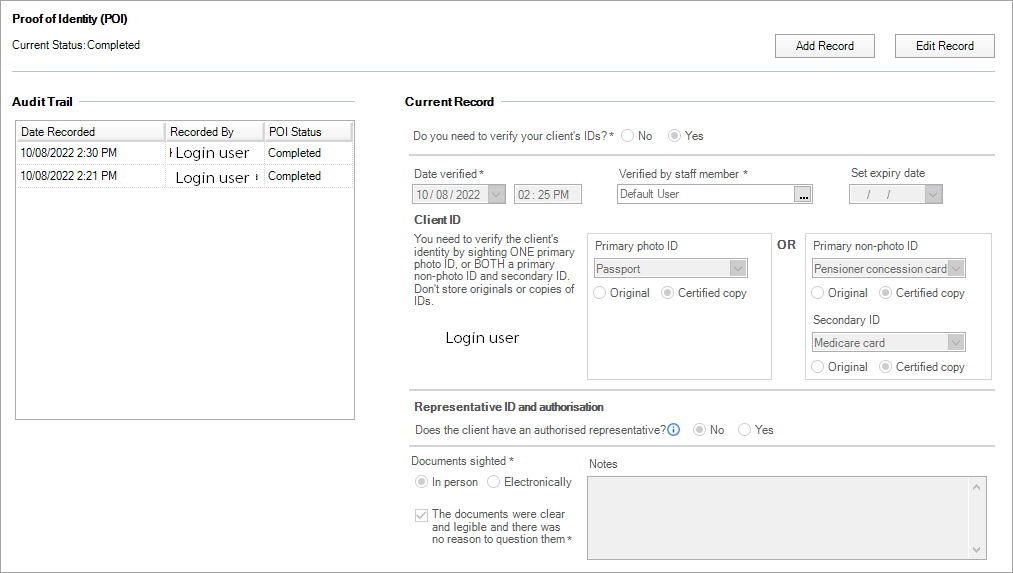

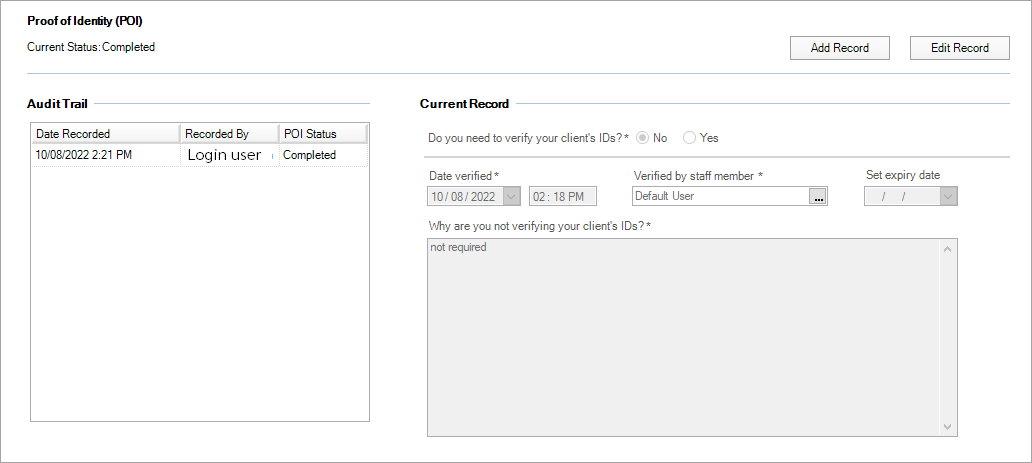

In AE/AO, we've created a new tab called Proof of Identity (POI) to record your client's ID.

POI status

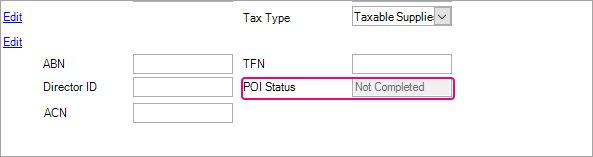

When you enter the POI for your clients, we will display the status in other sections within AE/AO.

If you don't see the field, right-click and select Field Chooser and select POI status from the list.

| Window in AE/AO | Fields displayed |

|---|---|

| Main tab |

|

| tax - Client search |

|

| Lodgment manager |

|

| Client search |

|

| Contacts search |

|

Activity Statement Obligation |

|