Resolving an out of balance Trial Balance in MAS

This support note applies to:

- AE MAS (NZ)

- AE MAS (AU)

Article ID: 27136

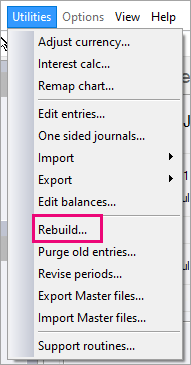

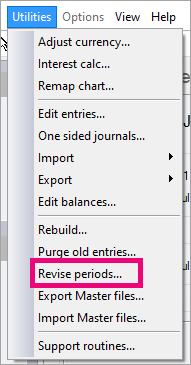

In an MYOB Accountants Enterprise (AE) Management Accounting System (MAS) ledger, if you experience a Trial Balance which does not balance, you need to perform the following tasks to rectify the error: